Housing, Inflation, and Consumer Confidence

New home sales drop as weather weighs on activity: Sales of new single-family homes declined 10.5% on a month-to-month basis and registered a seasonally adjusted annual rate of 657,000 units in January, the lowest level in three months. New home sales were below the consensus expectations of 698k units and dropped 1.1% from the same month of last year. A sizable pull-back in sales activity from the prior month in the Northeast (-20.0%), the Midwest (-16.7%), and the South (-14.8%) suggests that the steep declines were at least partly related to weather, as those regions were slammed by winter storms and chilled by frigid temperatures at the start of the year. On the other hand, the West experienced an increase of 7.7% despite wildfires in California. Elevated mortgage rates also kept new home sales low, as mortgage rates reached an 8-month high in mid-January before trending down in the past six weeks. With rates moderated in February, sales could bounce back in the following monthly report. The rising trend will hopefully continue as the market gears up for the spring homebuying season. Meanwhile, new housing inventory climbed to 9.5 months, a jump from 8.0 months in December and an increase from 8.3 months in January 2024. New for-sale units increased by 1.4% to 495k, reaching the highest level since December 2007.

Fed’s preferred inflation gauge is easing for now: According to the Department of Commerce, the personal consumption expenditure price index (PCE) – the Fed’s favorite inflation indicator – increased 0.3% month-over-month in January and was up 2.5% from a year ago. Excluding food and energy, the core PCE recorded a 2.6% year-over-year increase, and reached the lowest level since June 2024. Despite the latest decline, inflation remains higher than the pre-pandemic norm and is still well above the Fed’s 2% target rate. Americans are concerned about tariffs that could potentially drive up inflation, and the latest expectations on price growth from University of Michigan’s Survey of Consumers climbed to the highest level since November 2023. Nevertheless, mortgage rates dipped after the release, with the average 30-year fixed rate mortgage declining 0.5% last Friday. Investors’ concern over the economic impact of the new administration’s trade policy is taking a breather for now.

Consumers feel less optimistic about the future: The Conference Board Consumer Confidence Index dropped sharply by 7.0 points to 98.3 and reached an 8-monthly cyclical low in February, as Americans grew more anxious about future labor market conditions and the economy’s outlook. The drop was the most significant monthly decline since August 2021 and was the third straight monthly dip since the end of last year. The Present Situation Index inched down 3.4 points to 136.5 in February, while the Expectation Index plunged 9.3 points from the prior month to 72.9. The sharp decline resulted in the Expectation index dipping below 80 for the first time since June 2024. Consumers were especially concerned about inflation’s outlook and future employment prospects. Their 12-month average inflation expectations jumped from 5.2% to 6% last month, while pessimism about the job market outlook worsened and reached a 10-month high. Mass layoffs in the federal government sector and worries about tariffs are likely contributing factors to the deterioration of consumer optimism.

Business leaders show optimism at the start of the year: The confidence levels between business leaders and consumers diverged in the latest report.CEO’s optimism increased from 51 in Q424 to 60 in Q125 and surged to the highest level in three years, according to the Conference Board Measure of CEO Confidence. CEOs were substantially more optimistic about the current economic conditions and their perspective on future outlook also improved. Over half (56%) of CEOs said that economic conditions will improve over the next six months, an increase from 33% reported in Q424. The share of CEOs who expected conditions in their industries to get worse dropped to 14% from 22% in the last quarter. Seven out of ten (71%) CEOs planned to raise wages by 3% or more in the next 12 months, an increase from 63% in Q424. When asked about risks impacting their industries, CEOs still ranked “Cyber” (55%) at the top of the list, followed by “Geopolitical instability (55%), and “legal and regulatory uncertainty” (46%).

Construction spending unexpectedly drops: U.S. construction spending in January dipped from the prior month but remained up mildly from the year-ago level. Total construction outlays fell 0.2% to $2,192.5 billion from $2,196.0 billion for the first month of 2025 but increased 3.3% from $2,122.2 billion in January 2024. The overall outlays came in lower than consensus expectations of 0%, as residential construction spending declined by 0.5% last month, dragging down the total construction spending. Although private single-family spending continued to expand with an increase of 0.6% in January, both multifamily (-0.7%) and home improvement (-1.5%) eased from the prior month. With new home sales falling and builder confidence pulling back, a slowdown in residential construction spending could continue in the next couple of months.

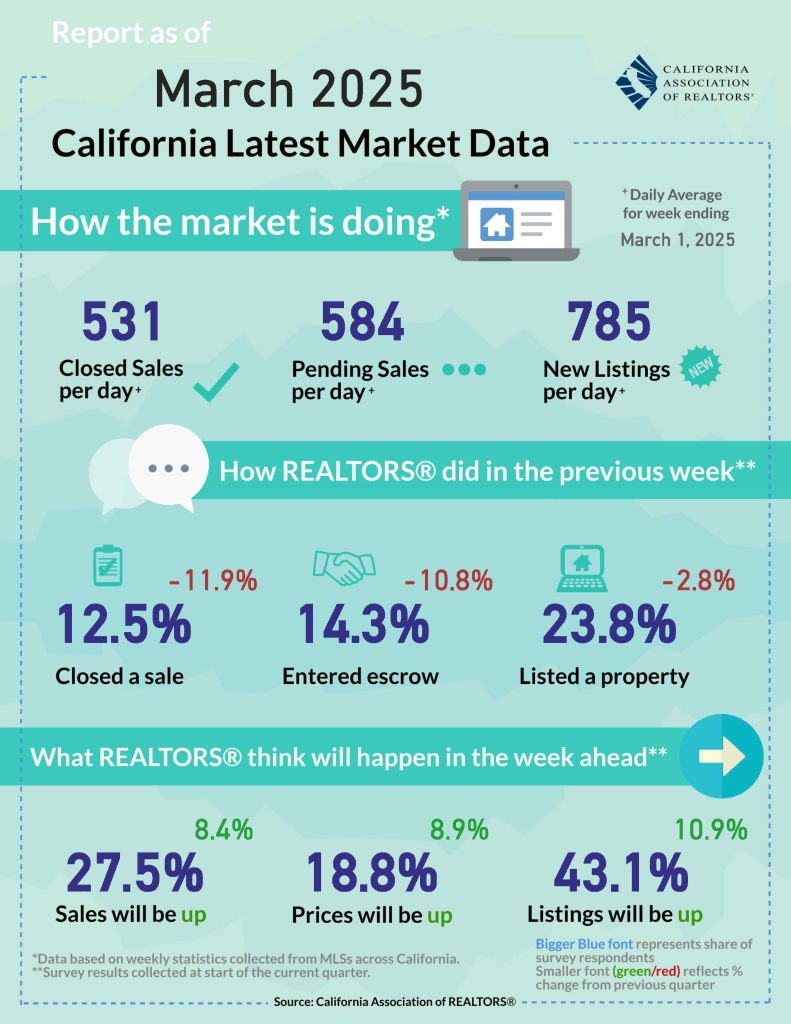

Source: California Association of REALTORS®