Mortgage delinquency rates remained stable due to a strong job market and moderate increases in home prices; higher home prices are expected to rise in 2024, and no recession is anticipated.

The economy is experiencing robust growth in the first quarter, driven by confident consumers who are spending resiliently. This spending resilience is preventing a fall in inflation but may pose challenges for the Federal Reserve in lowering interest rates. Despite consumer confidence remaining steady, there’s a slight dip in the short-term outlook due to concerns about the labor market and income prospects.

Consumer spending surged notably in February, particularly in the service sector, potentially complicating the Fed’s rate-cut decisions. However, new home sales softened in February, possibly influenced by increased mortgage rates and higher inventory in the resale market. Residential construction spending continued to rise, particularly in single-family units, despite a drop in overall construction spending. Mortgage delinquency rates remained unchanged from the previous year, staying near all-time lows due to a strong job market and moderate home price increases. With higher home prices expected to rise in 2024 and no recession anticipated, mortgage delinquencies are projected to remain stable in the coming months.

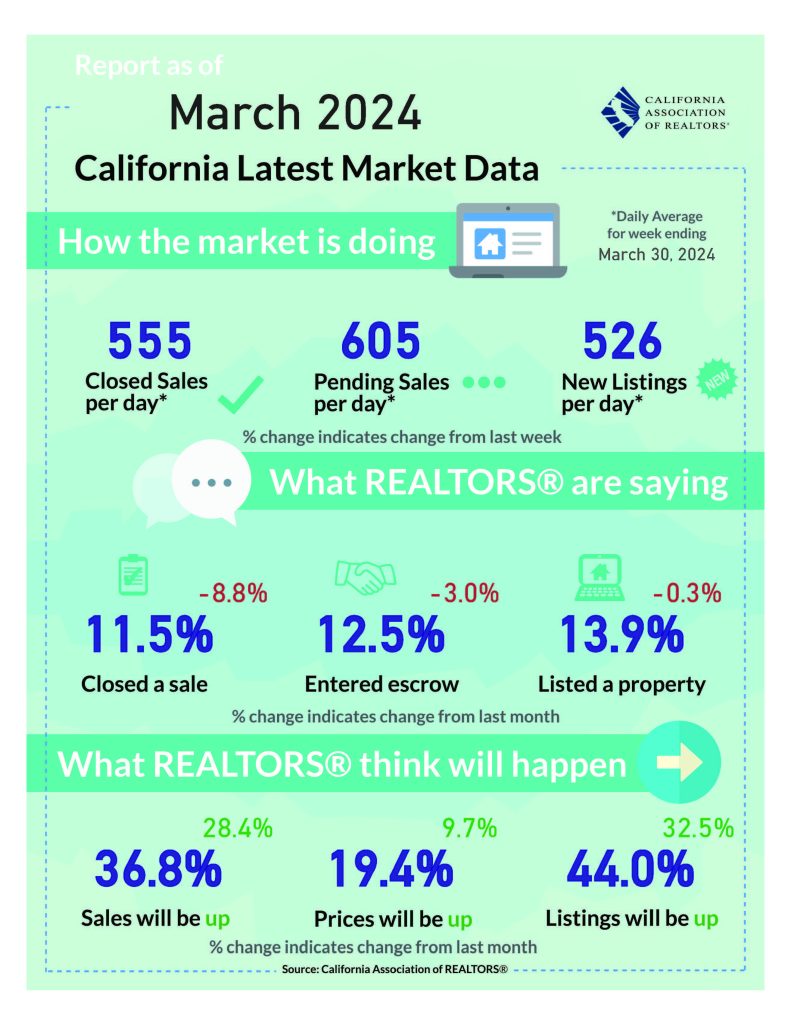

Source: California Association of REALTORS®