California Sees Major Sales Growth, Consumer Optimism Rises, and Small Business Confidence Soars Amid Inflation and Fed Rate Cuts

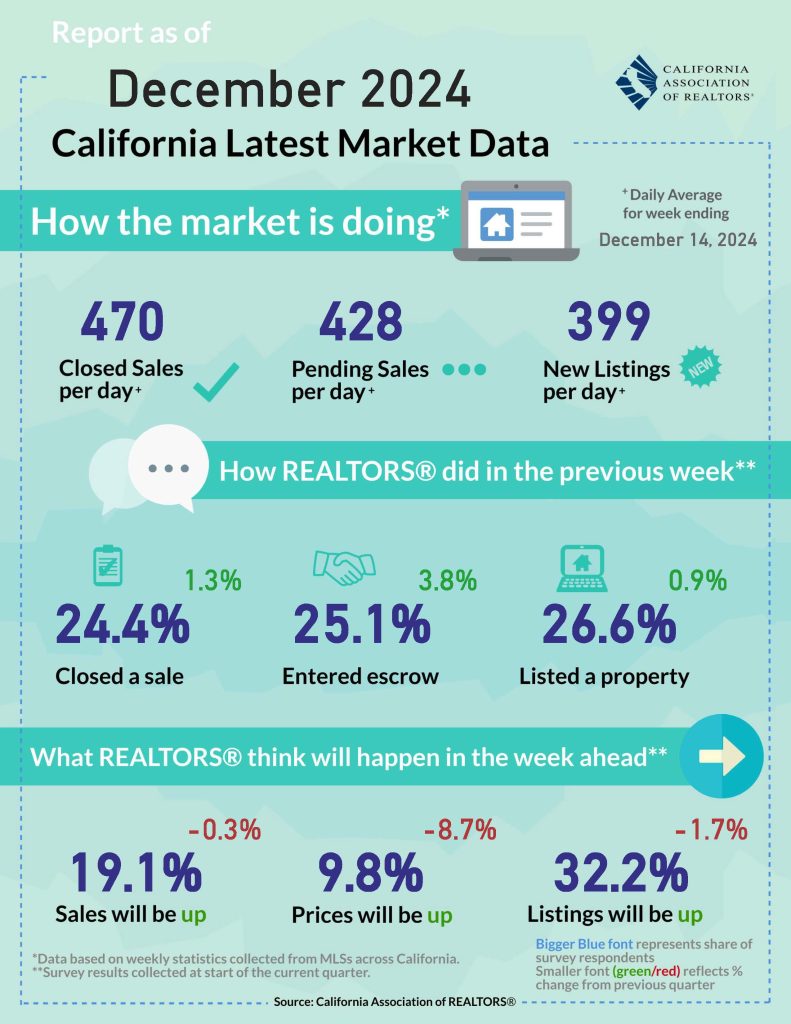

Despite elevated mortgage rates, the U.S. housing market showed signs of improvement as 2024 ended. In November, California experienced its most significant home sales increase since 2021, though sales remained below pre-pandemic levels.

Home prices in the state continued moderate growth, but the pace slowed, hinting at potential softening. Consumer sentiment also rose, with more expecting mortgage rates to decline. While still sticky, inflation aligned with expectations, with shelter costs contributing significantly to the CPI’s rise. The Federal Reserve is anticipated to cut rates by 25 basis points in December, though inflation’s slower decline may result in fewer cuts in 2025.

Small business optimism surged post-election, reaching its highest since June 2021, as owners were hopeful about future tax and regulatory changes. While uncertainties persist, lending conditions improved, and economic outlooks brightened, strengthening confidence among small business owners.

Source: California Association of REALTORS®