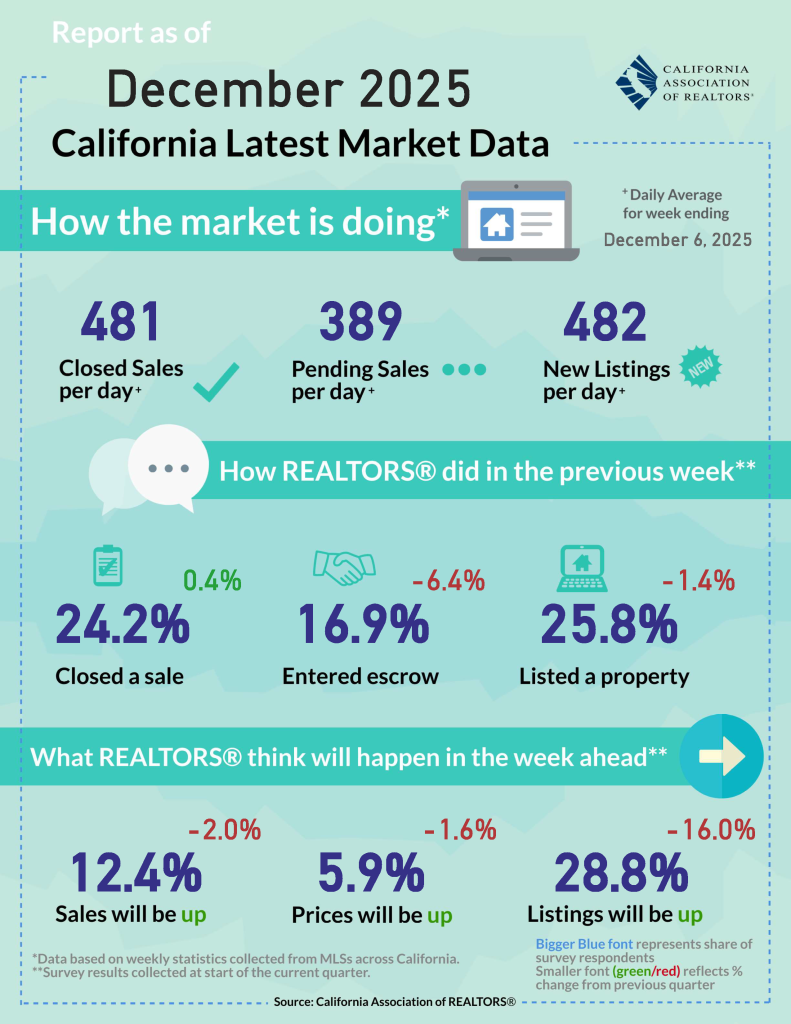

The Scarcity Factor– Decoding LA’s 482 New Listings Per Day

Here’s an overview of the somewhat confusing economic headlines, and what the massive news from the Federal Reserve means for your decision to buy or sell a home right now.

The Fed’s Gift: Rate Cuts Are Here

The Federal Reserve announced on Wednesday, December 10th, that it cut its benchmark interest rate by 0.25%—the third such cut in 2025. This decision was driven by the softening labor market (small businesses shed 120,000 jobs in November) and easing inflation.

What does this mean for YOU?

- Mortgage Rates: While the Fed doesn’t control long-term mortgage rates directly, this cut is a powerful signal. Analysts expect 30-year fixed rates, currently averaging around 6%, to come under downward pressure. Further cuts in 2026 could eventually push mortgage rates into the 5% range.

- Affordability Boost: Even a small rate drop significantly boosts buying power. Buyers who secure a lower rate can save thousands over the life of a loan.

Morgen Real Estate’s Strategic Takeaway

This cut fundamentally changes the playing field for 2026:

- For Buyers: The current period is a crucial window. Competition is expected to increase dramatically as affordability improves. Securing a purchase now lets you refinance later if rates continue to fall, potentially locking in substantial long-term savings.

- For Sellers: The market is about to get a boost in demand. The number one thing holding back sales—the cost of borrowing—is now dropping. We are watching the market closely to time your listing perfectly to capture the peak of renewed buyer confidence and activity in the spring market.

The bottom line is that the period of high interest rate uncertainty is ending. We are moving toward a more favorable housing borrowing environment.

Let’s chat about your specific goals and how to position your move perfectly for the coming year.

Source: California Association of REALTORS®