From Rates to Realities: California’s Housing Pulse

In June 2025, small business sentiment remained steady, with the NFIB Optimism Index barely dipping to 98.6—just above its 51-year average. A surge in excess inventories and rising concerns over taxes contributed to the dip, although worries over inflation declined. Interestingly, business uncertainty dropped five points, hinting at greater clarity despite persistent economic headwinds.

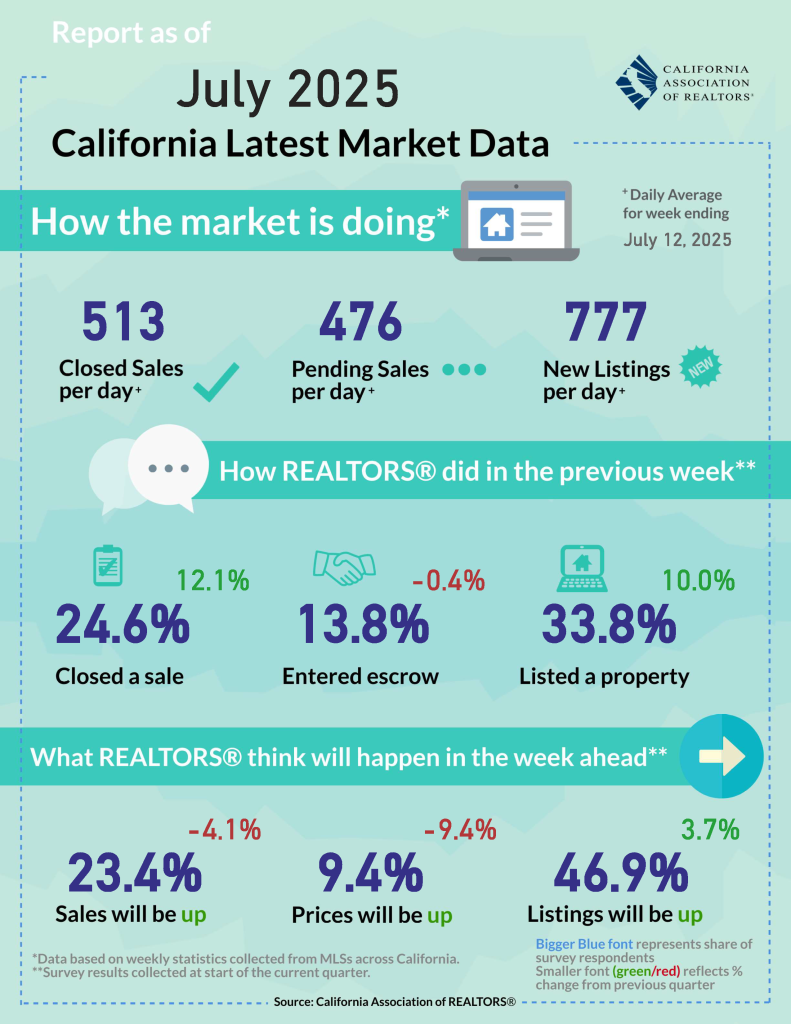

Meanwhile, mortgage applications jumped 9.4% in early July as interest rates eased. The Mortgage Bankers Association reported that refinance activity surged and purchase applications hit their highest seasonal level since early 2023. With average rates dipping to 6.77% and housing inventory rising, market activity may pick up through the second half of 2025.

However, homeowners are grappling with soaring insurance premiums. A report by Insurify predicts a national 8% rise in home insurance by year’s end, with California premiums spiking 21%—fueled by natural disasters and construction costs. Los Angeles County’s wildfire activity has further strained insurance affordability in the state.

On the buyer side, financial literacy remains a significant barrier for California renters. According to the C.A.R. 2025 Consumer Survey, the majority lack knowledge about mortgage requirements, down payments, and first-time buyer programs. Many are burdened by debt and unaware of their debt-to-income ratio, highlighting an urgent need for financial education.

At the same time, California’s housing supply remains tight, as homeowners opt to stay put. Nearly three-quarters haven’t considered selling in the past year, citing high mortgage rates and property taxes as key deterrents. More owners now plan to keep their homes for 15–24 years, contributing to inventory shortages and making it increasingly difficult for first-time buyers to enter the market.

Overall, while buyer interest is resurging, affordability, insurance pressures, and limited housing mobility continue to define California’s complex housing landscape.

Source: California Association of REALTORS®